Real Estate Investing Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of real estate investing with these essential tips and strategies that will help you navigate the market like a pro.

Real Estate Investing Basics

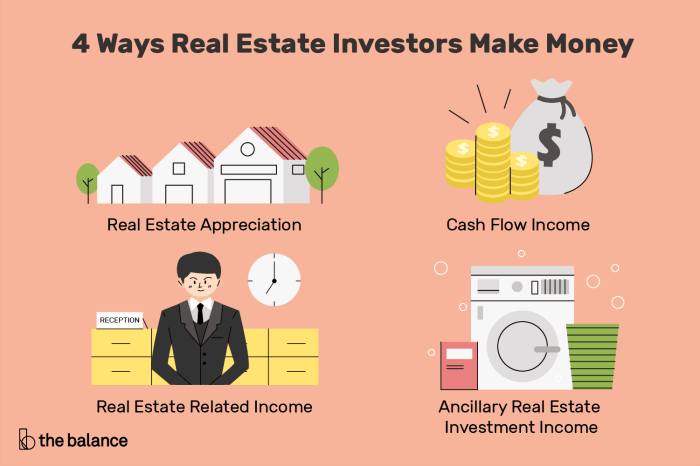

Investing in real estate involves purchasing, owning, managing, renting, or selling properties for profit. It is a popular form of investment due to its potential for long-term growth and passive income opportunities.

Types of Real Estate Investments

- Residential Real Estate: This includes single-family homes, condos, townhouses, and apartment buildings.

- Commercial Real Estate: Involves properties used for business purposes, such as office buildings, retail spaces, and warehouses.

- Industrial Real Estate: Includes properties used for manufacturing, production, storage, and distribution.

- Land: Investing in undeveloped land for future development or resale.

Advantages of Real Estate Investing

- Appreciation: Real estate tends to increase in value over time, providing potential for capital gains.

- Income Generation: Rental properties can generate regular rental income, providing a steady cash flow.

- Tax Benefits: Real estate investors can benefit from tax deductions, depreciation, and other tax advantages.

Key Factors to Consider Before Starting Real Estate Investing

- Market Research: Understand the local real estate market trends, property values, and rental demand.

- Financial Planning: Determine your budget, financing options, and expected return on investment.

- Risk Management: Assess potential risks such as market fluctuations, vacancy rates, and property maintenance costs.

- Property Management: Decide whether to manage the property yourself or hire a professional management company.

Market Research and Analysis

Market research is a crucial aspect of real estate investing as it helps investors make informed decisions based on current market conditions. By analyzing real estate market trends, investors can identify profitable opportunities and mitigate potential risks. Let’s dive into the key points to consider when conducting market research and analysis.

Importance of Market Research

- Understand local market dynamics, such as supply and demand, pricing trends, and economic indicators.

- Identify emerging neighborhoods or areas with potential for growth and high return on investment.

- Evaluate competition and assess the saturation of the market to determine the feasibility of investment projects.

- Stay updated on regulatory changes, zoning laws, and other factors that may impact property values.

Analyzing Real Estate Market Trends

- Monitor sales data, rental rates, and property appreciation to gauge the overall health of the market.

- Utilize real estate analytics tools and software to track market trends and forecast future developments.

- Consider macroeconomic factors like interest rates, inflation, and unemployment rates that influence the real estate market.

- Consult with local real estate agents, industry experts, and professionals to gain insights into market trends.

Identifying Lucrative Investment Opportunities

- Look for distressed properties, foreclosures, or off-market listings that offer potential for value appreciation.

- Evaluate the potential for rental income by analyzing rental demand, vacancy rates, and rental yields in the area.

- Assess the risk-return profile of different investment options and align them with your investment goals and risk tolerance.

- Explore different real estate investment strategies such as fix-and-flip, buy-and-hold, or short-term rentals based on market conditions.

Tools and Resources for Market Analysis

- Use online platforms like Zillow, Redfin, or Realtor.com to access property listings, sales data, and market reports.

- Subscribe to industry publications, attend real estate conferences, and join local real estate investment groups to stay informed.

- Engage with real estate professionals, appraisers, and lenders to gain insights into market trends and investment opportunities.

- Consider hiring a real estate market analyst or consultant to provide in-depth market research and analysis tailored to your investment needs.

Property Selection and Evaluation

Investing in real estate requires a strategic approach to property selection and evaluation to maximize potential returns. Let’s dive into the key factors to consider when choosing and assessing investment properties.

Criteria for Selecting Investment Properties

- Location: Choose properties in desirable neighborhoods with low crime rates, good schools, and amenities.

- Rental Yield: Look for properties with high rental yield potential to generate steady income.

- Market Trends: Research market trends to identify areas with high growth potential for property appreciation.

- Property Condition: Assess the condition of the property and potential repair costs before making a purchase.

Evaluating Property for Investment Potential

- Comparable Sales: Analyze recent sales of similar properties in the area to determine the market value.

- Rental Demand: Evaluate the rental demand in the area to ensure a steady stream of tenants.

- Cap Rate: Calculate the capitalization rate to assess the potential return on investment.

- Future Development: Consider any upcoming developments or infrastructure projects that could impact property value.

Factors Influencing Property Appreciation

- Economic Growth: Properties in areas experiencing economic growth tend to appreciate faster.

- Supply and Demand: Scarcity of properties in high-demand areas can drive up prices.

- Interest Rates: Lower interest rates can make property ownership more affordable, leading to price appreciation.

- Location Upgrades: Improvements in infrastructure or amenities can boost property values in the surrounding area.

Tips for Conducting Due Diligence

- Inspect the Property: Hire a professional inspector to assess the condition of the property.

- Review Financials: Analyze the property’s financial records, including expenses and rental income.

- Check Legal Issues: Verify the property’s title, any liens, or pending legal disputes that could affect ownership.

- Consult Experts: Seek advice from real estate agents, lawyers, and financial advisors to make informed decisions.

Financing Strategies

Real estate investments often require substantial capital, and understanding different financing options is crucial for success in this field. Leveraging other people’s money can help maximize returns, but it also comes with risks. Here, we will explore various financing strategies to help you navigate the world of real estate investing.

Types of Financing Options

When it comes to financing real estate deals, investors have several options to choose from:

- Traditional mortgages from banks or credit unions

- Hard money loans from private investors

- Owner financing where the seller acts as the lender

- Private money lenders or crowdfunding platforms

- Self-directed IRA or 401(k) loans

Pros and Cons of Using Leverage

Using leverage, or borrowed funds, to invest in real estate can amplify returns, but it also increases risk. Here are some pros and cons to consider:

- Pros: Increased buying power, higher potential returns, tax benefits

- Cons: Higher risk of loss, interest payments, potential foreclosure

Tips for Securing Funding

Securing funding for real estate deals can be challenging, but with the right approach, you can increase your chances of success:

- Build a strong credit profile and maintain good relationships with lenders

- Create a solid business plan and present your investment opportunities professionally

- Consider partnering with other investors to pool resources and reduce individual risk

- Explore creative financing options like seller financing or lease options

Strategies for Maximizing ROI

Maximizing return on investment (ROI) through financing involves careful planning and smart decision-making. Here are some strategies to help you make the most of your real estate investments:

- Utilize leverage wisely to increase cash-on-cash returns

- Monitor interest rates and refinance when favorable to lower borrowing costs

- Focus on properties with strong income potential and value appreciation

- Diversify your portfolio to spread risk and capture different market opportunities

Risk Management

Real estate investing comes with its fair share of risks that can affect your investments. It is crucial to be aware of these risks and implement strategies to mitigate them to protect your assets and maximize your returns.

Common Risks in Real Estate Investing

- Market Volatility: Fluctuations in the real estate market can impact property values and rental income.

- Vacancy Risk: Empty properties can lead to loss of rental income and increase expenses.

- Interest Rate Risk: Changes in interest rates can affect financing costs and profitability.

- Liquidity Risk: Real estate investments are not easily liquidated, making it harder to sell quickly in times of need.

Mitigating Risks in Real Estate Investments

- Conduct thorough market research and due diligence before investing in a property.

- Invest in diverse markets and property types to spread risk across your portfolio.

- Maintain a cash reserve for unexpected expenses or periods of vacancy.

- Consider insurance options like property insurance and liability coverage to protect your investments.

Importance of Diversification in a Real Estate Portfolio

Diversification is key to reducing risk in your real estate portfolio. By spreading your investments across different properties and markets, you can minimize the impact of market fluctuations and other risks on your overall returns.

Tips to Protect Your Investments from Unexpected Events

- Stay informed about market trends and economic indicators that could impact your investments.

- Regularly review and update your investment strategy to adapt to changing market conditions.

- Work with experienced professionals like real estate agents, property managers, and financial advisors to guide your investment decisions.

- Plan for contingencies and have a risk management strategy in place to handle unexpected events effectively.

Property Management: Real Estate Investing Tips

When it comes to real estate investing, property management plays a crucial role in ensuring the success and profitability of your rental properties. A property manager is responsible for overseeing daily operations, handling tenant issues, coordinating maintenance and repairs, and ensuring compliance with local laws and regulations. Hiring a property management company can offer numerous benefits, such as saving you time and hassle, maximizing rental income, and providing expertise in dealing with various aspects of property management.

Responsibilities of a Property Manager

- Collecting rent and handling finances

- Screening and selecting tenants

- Maintaining the property and coordinating repairs

- Enforcing lease agreements and resolving disputes

Benefits of Hiring a Property Management Company

- Expertise in legal and regulatory compliance

- 24/7 availability for emergencies

- Professional marketing and tenant screening

- Maximizing rental income and property value

Tips for Managing Rental Properties Effectively

- Communicate clearly with tenants about expectations and rules

- Maintain regular property inspections to identify maintenance issues early

- Keep detailed records of income and expenses for tax purposes

- Stay updated on local rental market trends and adjust rent accordingly

Handling Tenant Issues and Maintenance Concerns, Real Estate Investing Tips

- Address tenant concerns promptly and professionally

- Establish clear procedures for maintenance requests and repairs

- Work with reliable contractors and vendors for quality repairs

- Document all communication and actions taken regarding tenant issues