Disability insurance claims are a crucial aspect of financial protection for individuals facing disabilities, but understanding the process and potential hurdles can be complex. From filing a claim to overcoming challenges, this topic delves into the world of disability insurance claims.

Exploring the types of disability insurance, eligibility criteria, and common challenges, this comprehensive guide aims to shed light on a topic that impacts many lives.

Overview of Disability Insurance Claims

Disability insurance claims are requests made by individuals to their insurance providers to receive benefits when they are unable to work due to a disabling condition or injury. This type of insurance provides financial support to help cover living expenses and medical costs during the period of disability.

Process of Filing a Disability Insurance Claim

- Individuals must first gather documentation from healthcare providers to support their claim, including medical records and reports.

- Next, they submit a claim form provided by the insurance company, detailing the nature of their disability and how it impacts their ability to work.

- The insurance company will review the claim, possibly requiring additional information or assessments from medical professionals.

- If the claim is approved, the individual will start receiving benefits based on the terms of their policy.

Importance of Disability Insurance Claims

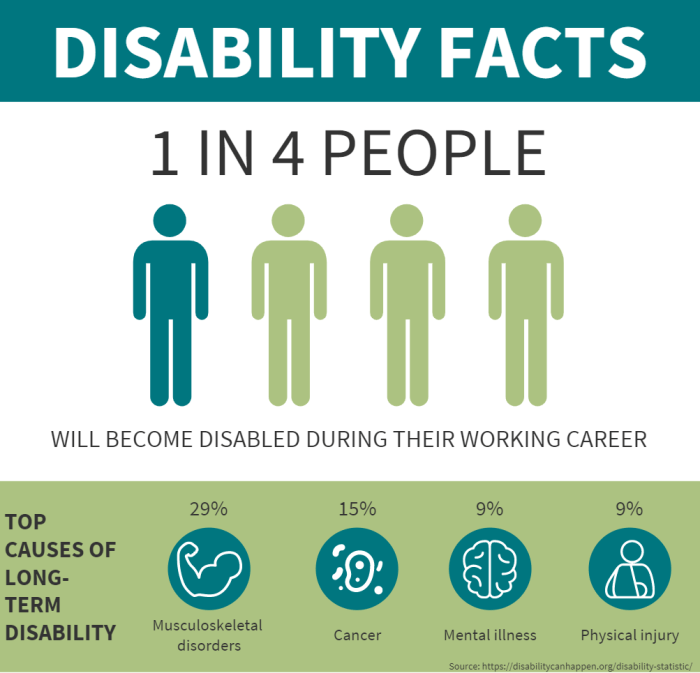

Disability insurance claims are crucial for individuals as they provide financial protection in case they are unable to work due to a disability. Without this coverage, individuals may struggle to meet their financial obligations and maintain their standard of living.

Common Reasons for Filing Disability Insurance Claims

- Severe injuries from accidents

- Chronic illnesses such as cancer or heart disease

- Mental health conditions like depression or anxiety

- Long-term disabilities from conditions like arthritis or back problems

Types of Disability Insurance: Disability Insurance Claims

Disability insurance comes in two main types: short-term disability insurance and long-term disability insurance. Each type serves different purposes and provides unique benefits to individuals who need financial assistance due to a disability.

Short-Term Disability Insurance

Short-term disability insurance typically provides coverage for a shorter period, usually up to six months. This type of insurance is designed to replace a portion of your income if you are unable to work temporarily due to a disability. It can help cover expenses such as medical bills, mortgage payments, and other daily living costs while you recover.

- Benefits of Short-Term Disability Insurance:

- Provides immediate financial support during a temporary disability.

- Offers a shorter waiting period before benefits kick in compared to long-term disability insurance.

- Helps bridge the gap between sick leave and long-term disability insurance benefits.

Long-Term Disability Insurance

Long-term disability insurance, on the other hand, provides coverage for a longer duration, often until retirement age if needed. This type of insurance is essential for individuals who suffer from a severe and long-lasting disability that prevents them from working for an extended period.

- Benefits of Long-Term Disability Insurance:

- Offers more comprehensive coverage for disabilities that last beyond the short-term.

- Provides financial protection for an extended period, potentially until retirement age.

- Assists in maintaining a stable income and financial security in the long run.

Examples of Situations, Disability insurance claims

Short-term disability insurance would be applicable in cases where an individual needs temporary financial support after surgery or a non-life-threatening illness that requires time off work for recovery. On the other hand, long-term disability insurance would be more suitable for individuals facing a permanent disability like a spinal cord injury or chronic illness that prevents them from working long-term.

Employer-Sponsored Disability Insurance

Employers may offer disability insurance as part of their benefits package to attract and retain employees. This can be a valuable asset for workers, providing them with financial security in case they become disabled and unable to work. By offering disability insurance, employers demonstrate their commitment to supporting their employees’ well-being and financial stability.

Eligibility Criteria for Disability Insurance Claims

To be eligible to file a disability insurance claim, individuals must meet certain requirements set by the insurance provider. These requirements typically include being unable to work due to a qualifying disability, having medical documentation to support the claim, and meeting any waiting period specified in the policy.

Medical Documentation for Eligibility

Medical documentation plays a crucial role in the eligibility process for disability insurance claims. This documentation often includes detailed reports from healthcare providers outlining the individual’s medical condition, treatment plan, and prognosis. Without adequate medical documentation, the insurance provider may deny the claim.

Exclusions and Limitations

There are certain exclusions and limitations related to eligibility for disability insurance claims. These may vary depending on the insurance policy, but common exclusions include pre-existing conditions, self-inflicted injuries, and disabilities resulting from illegal activities. It’s essential to review the policy carefully to understand these limitations.

Examples of Denial Scenarios

– Someone may be denied disability insurance coverage if their medical documentation does not clearly support the severity of their disability.

– Denial may occur if the disability is considered temporary or does not meet the definition of a qualifying disability under the policy.

– Individuals engaging in activities that are inconsistent with their claimed disability may also be denied coverage.

Common Challenges with Disability Insurance Claims

When it comes to filing disability insurance claims, individuals may encounter various obstacles that can make the process challenging. From dealing with paperwork to facing delays in approval, here are some common challenges you might face:

Potential Delays in Approval Process

One of the most frustrating challenges with disability insurance claims is the potential for delays in the approval process. This can occur due to a variety of reasons, such as missing documentation, incomplete medical records, or the need for additional information from healthcare providers. These delays can prolong the process and cause added stress for claimants.

Handling Claim Denials and Appeals Process

If your disability insurance claim is denied, it can feel like a major setback. However, it’s important to understand that denials are not the end of the road. Most insurance companies have an appeals process in place that allows claimants to challenge the decision. This process usually involves submitting additional evidence or documentation to support your claim.

Strategies for Overcoming Challenges

- Stay organized and keep detailed records of all communication and documentation related to your claim.

- Seek assistance from a legal professional or disability advocate who can help navigate the appeals process.

- Be proactive in providing any requested information promptly to avoid unnecessary delays.

- Stay informed about your policy coverage and rights as a claimant to ensure you are being treated fairly by the insurance company.