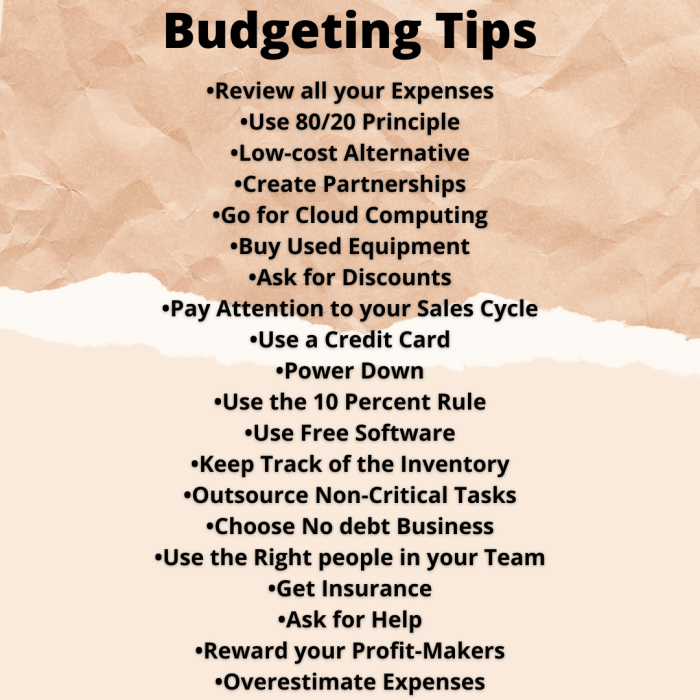

Budgeting tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of financial savvy with these killer budgeting tips that will have you slaying your money game in no time!

Importance of Budgeting

Budgeting is crucial for financial health as it helps individuals track their income and expenses, ensuring they are living within their means and saving for the future. Without a budget, it’s easy to overspend, accumulate debt, and struggle to reach financial goals.

Financial Goals Achieved Through Budgeting

- Building an emergency fund: By budgeting and setting aside a portion of income for emergencies, individuals can avoid financial crises and unexpected expenses.

- Saving for big purchases: Whether it’s a new car, a vacation, or a home, budgeting allows individuals to allocate funds towards these goals and make them a reality.

- Investing for the future: Budgeting helps individuals save and invest for retirement, ensuring financial security in the long run.

Consequences of Not Having a Budget

- Living paycheck to paycheck: Without a budget, individuals may spend all their income without saving for the future, leading to financial instability.

- Accumulating debt: Overspending without a budget can result in credit card debt, high-interest loans, and financial stress.

- Lack of financial progress: Without a budget, individuals may struggle to achieve their financial goals, such as buying a home or retiring comfortably.

Setting SMART Financial Goals

Setting financial goals is crucial in the budgeting process to help you stay focused and motivated towards achieving your desired financial outcomes. One effective way to set goals is by following the SMART criteria, which stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

Specific

When setting financial goals, it’s important to be specific about what you want to achieve. Instead of a vague goal like “save money,” a specific goal would be “save $500 per month.”

Measurable

Make sure your financial goals are measurable so you can track your progress. Having a measurable goal like “pay off $5,000 in credit card debt within 12 months” allows you to monitor how close you are to reaching your target.

Achievable

Setting achievable financial goals is essential to maintain motivation. Be realistic about what you can accomplish based on your income, expenses, and other financial commitments. Gradually increasing the amount you save or invest can help you reach larger financial goals over time.

Relevant

Ensure that your financial goals are relevant to your overall financial plan. Your goals should align with your values and priorities to keep you motivated. For example, if buying a house is a long-term goal, your short-term goals should support this objective.

Time-bound

Give yourself a deadline for achieving your financial goals. Setting a timeframe creates a sense of urgency and helps you stay on track. For instance, “build an emergency fund of $3,000 within 6 months” sets a clear deadline for reaching that specific goal.

Financial goals play a crucial role in the budgeting process by providing a roadmap for your financial journey. By setting SMART financial goals, you can establish clear objectives, track your progress, and stay motivated to achieve financial success.

Creating a Budget Plan

Creating a budget plan is essential for managing your finances effectively. It helps you track your income and expenses, identify areas where you can save money, and work towards achieving your financial goals.

Steps in Creating a Budget Plan

- List all sources of income: Include your salary, bonuses, side hustles, or any other money coming in.

- Track your expenses: Keep a record of everything you spend money on, from bills to groceries to entertainment.

- Categorize your expenses: Divide your expenses into categories like housing, transportation, food, and utilities.

- Set financial goals: Determine what you want to achieve with your budget, whether it’s saving for a vacation or paying off debt.

- Create a spending plan: Allocate a specific amount of money to each expense category based on your income and financial goals.

- Review and adjust: Regularly review your budget to see if you’re staying on track and make adjustments as needed.

Budgeting Methods, Budgeting tips

- Zero-Based Budgeting: In this method, every dollar you earn is assigned to a specific category, ensuring that your income minus your expenses equals zero.

- 50/30/20 Rule: With this rule, 50% of your income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment.

Importance of Tracking Expenses

Tracking expenses is crucial in budgeting because it helps you understand where your money is going. By keeping a close eye on your spending habits, you can identify areas where you may be overspending and make necessary adjustments to stay within your budget.

Saving Strategies: Budgeting Tips

Saving money effectively is crucial for financial stability. By following a budget and implementing smart saving strategies, you can build a strong financial foundation for the future.

Importance of Emergency Funds

Having an emergency fund is essential for unexpected expenses like medical emergencies or car repairs. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Cutting Down on Expenses

– Cook at home instead of eating out to save money on dining expenses.

– Cancel unused subscriptions or memberships to reduce monthly expenses.

– Buy generic brands instead of name brands to save money on groceries and household items.

– Use public transportation, carpool, or bike to work to save on gas and parking costs.

– Shop during sales or use coupons to save money on clothing and other purchases.

– Negotiate with service providers to lower monthly bills for cable, internet, or phone services.