Flood insurance policies are a must-have for homeowners looking to protect their property. Dive into the world of flood coverage with us as we explore the ins and outs of this crucial insurance option.

From understanding the different policy types to navigating the claims process, we’ve got you covered with all you need to know about flood insurance policies.

Importance of Flood Insurance Policies

Having flood insurance policies is crucial for homeowners to protect their property and finances in case of unexpected flooding events.

Not having flood insurance coverage can expose homeowners to significant risks, including financial devastation, property damage, and emotional stress.

Risk of Property Damage

- Flooding can cause extensive damage to the structure of the house, including walls, floors, and foundation, leading to costly repairs or even full reconstruction.

- Water damage can destroy personal belongings such as furniture, electronics, and sentimental items, resulting in irreplaceable losses.

Financial Protection

- Without flood insurance, homeowners may have to cover all repair and replacement costs out of pocket, potentially draining their savings and causing long-term financial strain.

- In contrast, having flood insurance can provide financial relief by covering the expenses associated with flood damage, allowing homeowners to recover and rebuild without facing a financial crisis.

Peace of Mind

- Knowing that you have flood insurance can give homeowners peace of mind, especially in flood-prone areas, where the risk of flooding is higher.

- In the event of a flood, having insurance can be a lifesaver, offering a safety net and ensuring that homeowners can focus on recovery without worrying about the financial burden of repairs.

Types of Flood Insurance Policies

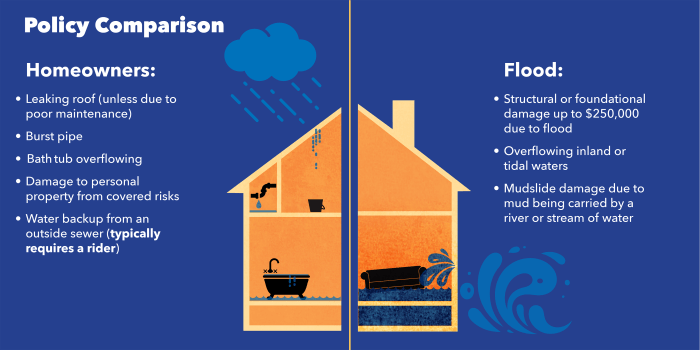

When it comes to flood insurance policies, there are two main categories to consider: government-backed options and private insurance choices.

Government-Backed Flood Insurance Policies

Government-backed flood insurance policies are typically provided through the National Flood Insurance Program (NFIP). These policies are offered by the Federal Emergency Management Agency (FEMA) and have specific coverage limits and exclusions. They are available to homeowners, renters, and business owners in participating communities.

- Coverage Limits: Government-backed policies usually have coverage limits of up to $250,000 for the structure of the building and up to $100,000 for personal belongings.

- Exclusions: Some common exclusions from coverage include damage to basements, crawl spaces, and decks.

- Examples of Coverage: These policies typically cover damage to the building structure, electrical and plumbing systems, appliances, and personal belongings such as furniture and clothing.

Private Flood Insurance Options

Private flood insurance policies are offered by private insurance companies outside of the NFIP. These policies may offer higher coverage limits and additional benefits compared to government-backed options.

- Coverage Limits: Private flood insurance policies may provide coverage limits higher than those offered by the NFIP, depending on the insurance provider.

- Exclusions: Exclusions vary by policy but may include coverage for additional living expenses or business interruption.

- Examples of Coverage: Private policies can cover a wide range of damages, including structural damage, personal property, temporary housing costs, and even landscaping expenses.

Factors Influencing Flood Insurance Premiums: Flood Insurance Policies

When it comes to determining flood insurance premiums, several factors come into play that can affect the cost of coverage. These factors include the location of the property, the level of flood risk in that area, the age and construction of the home, as well as coverage limits and deductibles.

Location and Flood Risk

The location of a property plays a significant role in determining flood insurance premiums. Properties located in high-risk flood zones, such as coastal areas or near rivers and lakes, are more likely to experience flooding and therefore have higher premiums compared to properties in low or moderate-risk areas.

Age and Construction of Home

The age and construction of a home can also impact flood insurance costs. Older homes may be more susceptible to flood damage due to outdated building materials or construction methods, resulting in higher premiums. Additionally, homes with elevated foundations or flood-resistant construction may qualify for lower premiums.

Coverage Limits and Deductibles

In addition to location and home characteristics, coverage limits and deductibles chosen by the policyholder can influence flood insurance premiums. Opting for higher coverage limits or lower deductibles will typically result in higher premiums, while choosing lower coverage limits or higher deductibles can help reduce insurance costs.

Process of Obtaining Flood Insurance

When it comes to purchasing flood insurance, there are specific steps that homeowners need to follow. This includes understanding the documentation required for the application process and knowing how to find the right policy that suits their needs.

Steps in Purchasing Flood Insurance, Flood insurance policies

- Research Insurance Providers: Start by researching different insurance companies that offer flood insurance policies in your area. Look for reputable providers with good customer reviews.

- Contact Insurance Agents: Reach out to insurance agents from the companies you are interested in to discuss your specific needs and get quotes for flood insurance coverage.

- Determine Coverage Needs: Assess your property and determine the level of coverage you need based on factors like location, flood risk, and property value.

- Fill Out Application: Complete the necessary application forms provided by the insurance company, providing accurate information about your property and flood risk.

- Submit Documentation: Along with the application, you may need to provide documentation such as property surveys, elevation certificates, and proof of ownership.

- Review and Purchase Policy: Once your application is approved, review the policy details carefully, including coverage limits, deductibles, and exclusions, before purchasing the policy.

Documentation Required for Flood Insurance Application

- Property Information: Details about the property’s location, size, construction type, and flood risk zone.

- Elevation Certificate: A document that shows the property’s elevation in relation to the base flood elevation.

- Proof of Ownership: Documents such as property deeds or titles to prove ownership of the property.

- Prior Insurance History: Information about any previous flood insurance coverage or claims history.

Tips for Finding the Right Flood Insurance Policy

- Compare Multiple Quotes: Obtain quotes from different insurance providers to compare coverage options and premiums.

- Consider Additional Coverage: Look for policies that offer supplemental coverage for contents, temporary living expenses, and basement flooding.

- Review Policy Exclusions: Pay attention to exclusions in the policy, such as coverage limits for certain types of property or damage.

- Ask Questions: Don’t hesitate to ask your insurance agent about any aspects of the policy that are unclear or need further explanation.

Claims Process for Flood Insurance

When it comes to filing a flood insurance claim, homeowners need to follow a specific process to ensure a smooth and successful outcome. Understanding the typical timeline and steps involved in processing a flood insurance claim can help homeowners navigate the situation effectively. Additionally, there are tips that can maximize the chances of a successful flood insurance claim.

Filing a Flood Insurance Claim

- Contact your insurance provider as soon as possible after the flood event to report the damage and initiate the claims process.

- Provide all necessary documentation, including photos of the damage, inventory of items lost, and any relevant receipts or proof of purchase.

- An adjuster will be assigned to assess the damage and determine the coverage amount for your claim.

Timeline and Steps in Processing a Flood Insurance Claim

- Initial contact with insurance provider and claim filing.

- Assessment of damage by an adjuster.

- Review of documentation and determination of coverage amount.

- Approval and disbursement of claim payment.

Tips for Maximizing Successful Flood Insurance Claims

- Document all damage thoroughly with photos and videos before cleaning up or making repairs.

- Keep all receipts and invoices related to repairs and replacements for reimbursement.

- Stay in communication with your insurance provider throughout the claims process to ensure a timely resolution.